2026 Global REITs Outlook – Regional Divergence and Sector Opportunities

January 2026

REGIONAL DIVERGENCE AND SECTOR OPPORTUNITIES

2026 GLOBAL REITS OUTLOOK

Key Takeaways

Click each region to jump to the relevant section.

• Relative stability in the U.S. economy should lead to a more neutral Federal Reserve stance in 2026.

• Shopping Centers show strong supply/demand fundamentals and are pricing in a misperception of risk, presenting a compelling opportunity at a discounted valuation.

• U.S. Senior Housing fundamentals are driven by favorable demographics, and we expect growth to continue unabated in 2026.

• JREITs’ focus on capturing inflation through rent growth coupled with improvement in governance points to additional upside, particularly in Tokyo Office.

• After a rocky year for U.S.-China trade negotiations, China’s growth in 2026 will be largely determined by Beijing’s efforts to enact policies to boost household consumption.

• Australia faces sticky inflation, but this inflation rooted in economic strength should translate to rent and occupancy growth, a benefit to the AREITs.

• Economic growth and policy response vary across the region; the U.K. might see additional interest rate cuts, while the ECB and Sweden could raise rates later in the year or early next.

• European Healthcare is supported by the same aging demographics seen in the U.S., while the U.K. Primary Care sector is experiencing the need for more investment due to government policy.

• The U.K. Logistics sector offers compelling relative growth as new supply slows, particularly for regional big box product.

Global REIT Outlook

The global equity markets are already reacting to volatility in currencies, rates, commodities, and continued heightened geopolitical risks to kick off 2026. In this uncertainty, real estate remains a local, market-specific asset class benefitting from fundamentals in local markets – from aging demographics to consumption patterns. As investors look to diversify their portfolios to manage risks, global equity market breadth is normalizing and REITs are uniquely positioned in this backdrop.

Equity multiples for global REITs compared to global equities are nearly 30% cheaper than historical levels. Normalization of market breadth and real estate capital markets should provide support for real estate valuations, narrowing this disconnect in multiples between REITs and broader equities. The last time REITs traded at this deep discount versus equities was in the aftermath of the GFC when REITs outperformed equities by 8.7% in the 12 months following and 25.1% in the 24 months following. In this installation of our outlook series, we discuss our expectations for the REIT market across the U.S., Europe, and Asia Pacific regions, including sectors we anticipate to generate the strongest results in the coming year.

U.S.

The macroeconomic backdrop for the U.S. entering 2026 feels benign: steady growth supported by consumer spending and strong corporate balance sheets funding the digital infrastructure buildout. Inflation, though above the Fed’s 2% target, seems more under control, and the unemployment rate is relatively low. Taken together, the Federal Reserve is not under pressure to shift policy to start the year, though could continue easing policy rates slightly, moving toward a more neutral stance in the second half of 2026.

However, some risks remain top of mind. Hiring momentum has slowed, wage growth is moderating, and unemployment, though still low on an absolute basis, has risen slightly, creating the risk of a sharper deterioration in the labor market if layoffs accelerate. Inflation also remains uncertain. While shelter inflation is easing, persistent inflationary pressures from infrastructure spending, energy demand tied to electrification and AI, tighter labor supply due to immigration policies, and ongoing fiscal deficits have kept inflation above the Fed’s target. Further, as we approach the midterm elections later this year, political and geopolitical risks remain in the spotlight.

Taken together, we anticipate the 10-year Treasury yield to remain range-bound between 4.0% and 4.5%, reflecting moderate growth, steady inflation, and a structurally higher term premium. Stability in interest rates should finally bring a recovery in transaction activity for commercial real estate and with it, the beginning of a new real estate cycle. The REIT market is poised to benefit from this in two ways. First, REITs have historically taken advantage of resetting markets to launch accretive acquisition cycles to drive external growth. Second, certain sectors that are trading significantly below their underlying real estate net asset values (NAV) due to negative sentiment (rather than negative fundamentals) should benefit from price discovery in the private markets and potential M&A activity. Two sectors positioned to benefit from these catalysts are Shopping Centers and Senior Housing.

Shopping Centers

U.S. Shopping Centers benefit from one of the most favorable supply-demand dynamics in commercial real estate, demonstrating significant increases in foot traffic over the past five years, especially compared to other retail property types (Figure 1). New supply has been minimal since the GFC, constrained by elevated construction costs and assets trading well below replacement cost. At the same time, population growth, suburbanization, and the resilience of necessity-based retail—particularly grocery-anchored centers—have driven strong tenant demand. As a function, leasing conditions are the strongest in decades, with robust pipelines and leasing spreads. Despite the strength in fundamentals, headlines around some retailer bankruptcies and caution about consumer strength weighed on this sector in 2025, which underperformed the REIT market by 8%, and is entering 2026 at an attractive valuation.

We believe sentiment to be overly bearish and believe this sector is pricing in a misperception of risk, trading at an average 6.9% implied NOI cap rate across the sector, presenting a material discount to the underlying NAV. This is notable given the private market’s renewed interest in the sector after nearly a decade. The compelling valuation combined with the solid fundamentals underscore our conviction in this sector going into 2026.

Figure 1: Retail Foot Traffic Changes

*Strip center foot traffic based on REIT portfolios. Traffic by retailer category are on a comparable, same-store basis (i.e., data was adjusted for store closings and openings).

Source: Placer.ai, Green Street, as of September 2025.

Healthcare (Senior Housing)

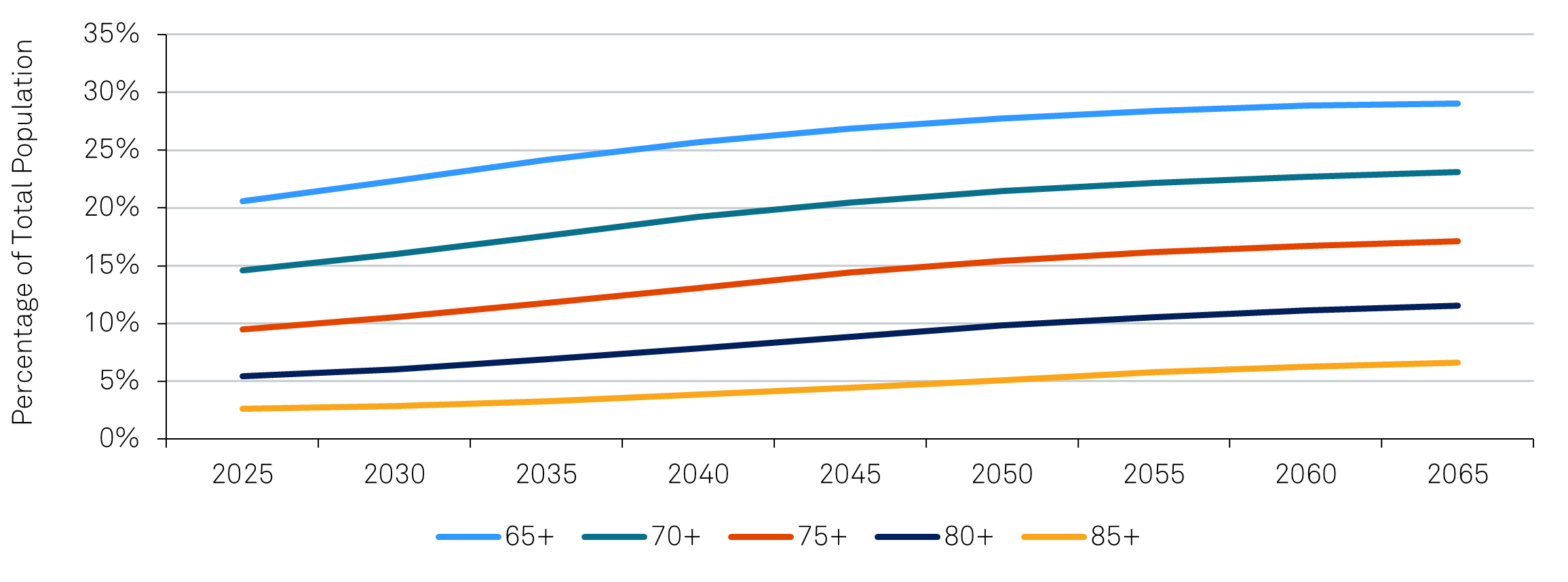

Senior housing continues to benefit from powerful demographic tailwinds, with the 80+ cohort set to grow at a 5% CAGR from 2026-2030 (Figure 2) while new supply is expected to remain below 1% of existing stock through 2027 as new development remains economically unviable. Rising occupancies and strong pricing power are driving high single-digit revenue growth, translating into low double-digit NOI growth due to the sector’s high level of operating leverage. Beyond strong internal growth, the sector benefits from a meaningful cost-of-capital advantage that supports accretive external growth—a dynamic we expect to increasingly extend across listed real estate. Trading at premiums to NAV, the healthcare REITs can deploy their competitive cost of capital into opportunities with distressed capital or operational structures. Given the highly specialized nature of senior housing operations, listed REITs possess an operational advantage that private capital often lacks, limiting competition and expanding the acquisition opportunity set. Together, strong internal fundamentals and a favorable external growth runway should support low-teens earnings growth for the sector in the coming years.

This growth, however, is not a secret. The sector handily outperformed the REIT market in 2025 by about 50%, though the sector did experience a pullback more recently, correcting valuations slightly. Despite the sector trading at a premium to its underlying net asset values and at multiples that are elevated versus the rest of the REIT market, we believe earnings are poised to outperform expectations and the underlying fundamentals will continue unabated, supporting our conviction in the sector going into 2026.

Figure 2: 80+ Year Old Growth

Source: Census, as of January 25, 2026.

Asia Pacific

In Japan, the transition to a sustained inflationary environment continues to reshape behavior. While rising inflation supports rental growth, the resulting higher interest rates are also increasing financing costs. With the Bank of Japan expected to maintain a gradual path to normalization, the 10-year JGB yield is likely to remain anchored around 2.0%. Japanese real estate companies are increasingly focused on capturing rent growth through shorter leases, escalations, and more assertive negotiations, reinforcing earnings visibility. Combined with the continued improvements in governance and shareholder returns, 2026 should offer additional upside potential for Japanese real estate equities, especially those with exposure to Tokyo Office.

China has long grappled with a housing-led slowdown, which was compounded by U.S. tariffs in 2025; nevertheless, the economy met its 5.0% growth target, supported by a widening current account surplus driven by stronger EM exports and a modest pickup in domestic consumption. Looking into 2026, trade should be less of a constraint following recent U.S.–China negotiations, but domestic investment—a key growth pillar—has weakened materially across real estate, infrastructure, and manufacturing. In response, Beijing has refocused policy on boosting household consumption through higher social welfare spending, new consumption subsidies, and efforts to support wage growth, with the success of these measures likely to be a key determinant of China’s growth trajectory beyond 2026.

Australia’s economy remains underpinned by strong consumption supported by a resilient labor market with accelerating wage growth and steady population growth. However, stickier-than-expected inflation has shifted monetary policy expectations from cuts to potential hikes, which has already had a headwind effect on equities that will likely persist for some time longer, but it is worth reiterating that the elevated inflation figure is rooted in economic strength. As that strength flows into rent and occupancy growth across real estate, the AREITs should benefit

Tokyo Office

Tokyo’s Office market has been in a sustained upcycle for nearly two years, with rents rising for 22 consecutive months as of November 2025 and vacancies falling (Figure 3). Vacancy across the central five wards has fallen to 2.4%, the lowest level since mid-2020, and with new supply forecast to remain broadly flat, vacancies are expected to stay low or tighten further. Historically, Japanese Office cycles have been long—most recently from 2014 to 2021—and the current cycle could extend even longer as rising construction costs and a shrinking construction workforce constrain new development. Delays to smaller projects are already evident, a trend likely to continue.

Demand conditions remain supportive, with positive net take-up throughout 2025 and approximately 75% of 2026 space already pre-leased. Market rents rose 5.3% year-on-year in November, and further increases are expected as landlords adopt more assertive lease structures to reflect the inflationary environment, moving away from traditional fixed-rent, open-ended leases. Office JREIT valuations have risen, with some trading at premiums to NAV, which could open the door for equity-funded acquisitions of sponsor assets, which are often acquired at discounts to market valuations and could create additional, longer-term earnings upside. While a broader economic slowdown could temper demand, a sharp deterioration appears unlikely given the lack of a meaningful supply response, supporting a multi-year outlook for rent growth and high occupancy.

Figure 3: Tokyo Office Rent Growth and Vacancy Rate

Source: Miki Shoji, as of November 2025.

Hong Kong Retail

While the upcycle in Tokyo Office is already a few years in, the inflection point for Hong Kong retail just began in 2025 after nearly a decade of headwinds—from Occupy Central and COVID to retail sales leakage into mainland China following improved transport links. Retail sales, which declined 7.4% in 2024, turned positive in mid-2025 and accelerated to 6.9% by October (Figure 4). New retail supply is expected to increase modestly in 2026, but at roughly 300,000 square feet it remains well below the historical average of 900,000 square feet, supporting a gradual normalization in fundamentals.

Taken together, while retail rents may still soften in 2026, with sales growth stabilizing, cross-border leakage largely contained, and visitor arrivals recovering, rents are likely to bottom in 2026 before beginning a gradual recovery. Valuations of retail landlords remain attractive, with key sector proxies trading at double-digit discounts to their historical 7- and 5-year valuations. The primary risk to this outlook is rising competition from mainland Chinese e-commerce platforms expanding into Hong Kong via Shenzhen, which could slow the pace of recovery if adoption accelerates.

Figure 4: Hong Kong Retail Sales Growth and Tourist Arrivals

Source: Census & Statistics Department Hong Kong, as of December 2025.

Europe

European economic growth is expected to remain modest in 2026, with Spain and Sweden expected to outperform, driven by tourism and tax cuts, respectively, while France and Italy are expected to lag due to fiscal consolidation pressures. With most interest rate cuts already delivered, monetary policy across much of the region is entering a more stable phase, though the U.K. could see one or two more interest rate cuts and the ECB and Sweden could potentially raise rates at the end of 2026 or early 2027 dependent upon growth. Swap rates and credit spreads are lower in all regions than they were at the start of 2025, supporting refinancing conditions, and we expect them to remain stable here unless Sovereign bond yields continue to widen. Political uncertainty remains elevated in France, while the U.K. faces fiscal risks if growth disappoints.

Leverage concerns across real estate companies have eased following interest rate cuts, though refinancing challenges persist for issuers with longer-dated maturities. We expect yields to remain broadly stable across most sectors, with modest valuation upside driven by market rent growth in areas such as German residential. Prime assets should continue to outperform secondary, particularly within office and retail.

Overall, the U.K. appears more attractive than continental Europe, with listed stocks exhibiting lower leverage and greater embedded rental reversion given less automatic inflation indexation. We expect low single-digit earnings growth on average and total shareholder returns, including dividends, to be greater than 10%. Opportunistic M&A should remain a key theme as public valuations continue to screen cheap relative to private markets, similar to the U.S., potentially supported by equity issuance as discounts narrow. Within this environment, we favor defensive and secular growth sectors like healthcare and industrial, see opportunity in AI-driven data centers, and are becoming more constructive on London office given depressed valuations

Healthcare

Similar to the trends we see in the U.S., the aging population continues to provide structural demand for the Healthcare sector across Europe, particularly Senior Housing (Figure 5). In a more benign inflationary environment, operators have been able to better manage their costs and profitability has improved. The lag effect of higher bed costs from governments and municipalities coupled with rising occupancy as demand accelerates has led to much better prospects in a sector that still has relatively high yields in Europe compared to other sectors such as Office.

Within the U.K. Primary Care sector, the drive for governments to increase outpatient care to reduce costs is in turn increasing the need for more investment within primary care. With increasing budgets, the private sector and the primary Healthcare REITs need to play their parts to increase healthcare investment within the community. Both subsectors participated in M&A in 2025, and the larger combined companies should benefit from economies of scale and better costs of capital. We believe this remains underappreciated by the market. Small regulatory delays to a merger approval in Senior Housing REITS should lead to further upside once completed. Further growth through acquisitions as well as developments at increasingly attractive yields are likely in a sector that offers good defensive growth prospects at an attractive valuation.

Figure 5: Forecast Population Change by Age in European Union

Source: Eurostat, as of November 2025.

UK Logistics

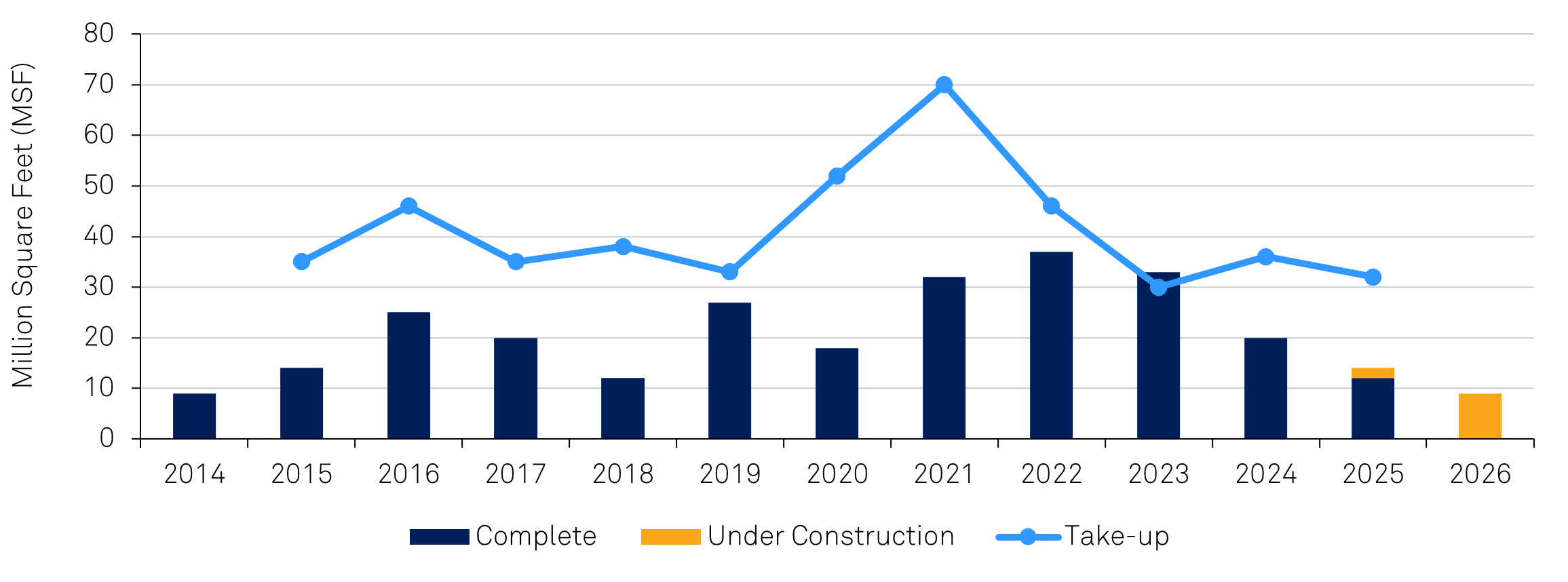

U.K. Logistics, particularly the big box product, continues to offer compelling relative growth prospects. New supply is slowing, as the large amount of speculative development has reduced significantly, and take-up for space remains comfortably above the levels of new development completions (Figure 6). Vacancy levels should support moderate rental growth, and strong demand for new big box space is driving vacancies even lower in that part of the industrial market.

The listed real estate industrial portfolios in the U.K. also benefit from significant embedded rent reversion since they have not yet captured indexation every year compared to the continent. However, London rents are at nearly double the levels of those in the Midlands and trading at much lower yields across the public markets. As such, our conviction within the U.K. Industrial sector is skewed toward the regional portfolios versus those concentrated in London because we continue to see higher earnings growth at lower multiples for regionally exposed REITs versus those primarily exposed to London. Additionally, for those companies with sizeable land banks and the capital to develop into a market with limited supply, this is producing further opportunities for value creation. With interest rates in the U.K. still expected to decline, there is also the added possibility for modest yield compression along with value increases from rental growth within the sector.

Figure 6: UK Industrial Take-up Recovering as Development Slows

Source: Knight Frank, as of November 2025.

Conclusion

The Global REIT landscape is entering 2026 with differentiated opportunity across regions and sectors. These dynamics reinforce the importance of selective, fundamentals-driven investment positioning as regional divergences shape global real estate performance in the year ahead. We’ve highlighted the sectors we believe illustrate where meaningful opportunities are most likely to emerge as the global narrative unfolds.

After a prolonged period of dislocation, global REITs enter 2026 with improving fundamentals and historically attractive valuations, setting the stage for selective outperformance across key sectors and markets.

General Disclosures

Any statement of opinion constitutes only the current opinion of CenterSquare and its employees, which are subject to change and which CenterSquare does not undertake to update.

Material in this publication is for general information only and is not intended to provide specific investment advice or recommendations for any purchase or sale of any specific security or commodity. Due to, among other things, the volatile nature of the markets and the investment areas discussed herein, investments may only be suitable for certain investors. Parties should independently investigate any investment area or manager, and should consult with qualified investment, legal, and tax professionals before making any investment. Some information contained herein has been obtained from third party sources and has not been independently verified by CenterSquare Investment Management LLC (“CenterSquare”). CenterSquare makes no representations as to the accuracy or the completeness of any of the information herein. Accordingly, this material is not to be reproduced in whole or in part or used for any other purpose. Investment products (other than deposit products) referenced in this material are not insured by the FDIC (or any other state or federal agency), are not deposits of or guaranteed by CenterSquare, and are subject to investment risk, including the loss of principal amount invested.

For marketing purposes only. Any statements and opinions expressed are as at the date of publication, are subject to change as economic and market conditions dictate, and do not necessarily represent the views of CenterSquare or any of its affiliates. The information has been provided as a general market commentary only and does not constitute legal, tax, accounting, other professional counsel or investment advice, is not predictive of future performance, and should not be construed as an offer to sell or a solicitation to buy any security or make an offer where otherwise unlawful. The information has been provided without taking into account the investment objective, financial situation or needs of any particular person.

This document should not be published in hard copy, electronic form, via the web or in any other medium accessible to the public, unless authorized by CenterSquare.