The next 12 months could be a tremendous time to deploy capital in commercial real estate, but valuation and fundamentals are more important than ever

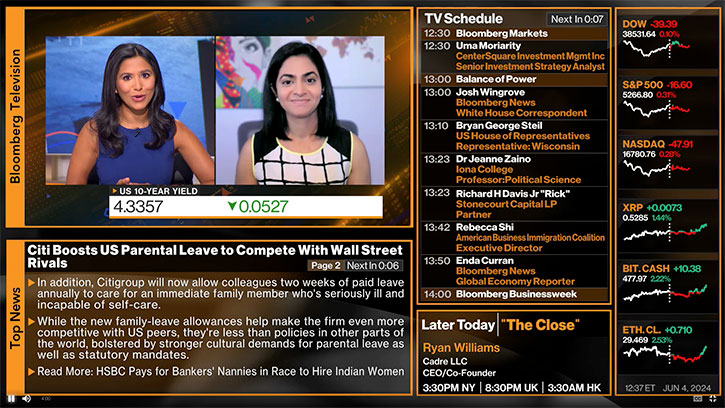

Plymouth Meeting, PA, January 9, 2024 — CenterSquare Investment Management (“CenterSquare”) today published an overview of its outlook for the commercial real estate market in 2024. The report, titled “A Reset Entry Point for Real Estate,” notes that the coming year could be an opportune time for capital deployment as well-capitalized bidders patiently wait for valuations to meet rational price levels. The report highlights CenterSquare’s topline expectations for several sectors within commercial real estate.

A full copy of the outlook overview can be downloaded here. In-depth, focused research and predictions across various real estate markets will be released as separate reports throughout the month. Topics include global REITs, private equity real estate, and private real estate debt.

“We believe interest rates have reset at higher levels than we were used to seeing in the last decade, and real estate will have to be repriced in this new reality of debt costs. As this repricing occurs, we expect the coming year to be marked by incredible opportunities for investors to deploy capital across the real estate asset class,” said Todd Briddell, Chief Executive Officer and Chief Investment Officer at CenterSquare. “However, not all real estate is created equal. Navigating the shifting fundamentals, capital markets, and government policies will be critical in identifying asymmetric payoffs most likely to succeed.”

The gap between valuations in REITs and private real estate markets remains extraordinarily wide and CenterSquare expects that, as debt comes due in 2024, private market real estate values across sectors will need to come down. These resetting valuations will provide an excellent vintage for investors looking to deploy capital in the next two years.

The report also notes the discounted valuation for global REITs to be a catalyst for performance in 2024 as global central banks end their rate hiking cycle. In the real estate private debt market, CenterSquare sees 2024 as an opportunity for alternative lenders to provide gap capital in the form of mezzanine debt or preferred equity on high-quality assets as traditional lenders remain restricted in their capacity to deploy capital.