Joint Venture with Ultimate Realty Positioned to Meet Growing Tenant Demand

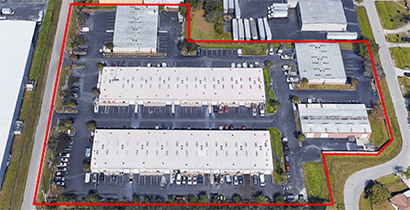

September 15, 2023 – CenterSquare Investment Management, in a joint venture with Ultimate Realty, has acquired an 8-building, 114,000 sf Service Industrial Portfolio located in the Fort Myers and Orlando MSAs. The portfolio consists of 5 buildings in Fort Myers and 3 buildings in St. Cloud (Orlando), FL with all properties 100% leased to a diversified tenant base. The buildings at both industrial parks feature >16’ clear heights, grade level loading, low percentage office finish, and ample parking space. The average tenant size across the 56-space portfolio is 2,200 sf.

This investment demonstrates CenterSquare’s conviction in the Service Industrial asset class where the Firm sees significant opportunity to institutionalize a fragmented sub-sector and enjoy operational economies of scale over the long term. Built to provide flexibility and access to consumers, Service Industrial properties are highly divisible, serving multiple tenants who have space needs ranging from 2,000 to 10,000 sf. The flexible space is ideal for tenants serving a wide array of uses, including the construction, supplier, and service provider industries. The supply of Service Industrial space is limited given barriers to entry and higher replacement costs, resulting in low vacancy and sustainable demand.

CenterSquare and Ultimate intend to enhance the functionality of both industrial parks to accommodate the evolving needs of the tenants in the vibrant Orlando and Fort Myers MSAs. The business plan contemplates addressing deferred maintenance and capital improvements including painting the exterior, improving storefronts, and asphalt repair and restriping.

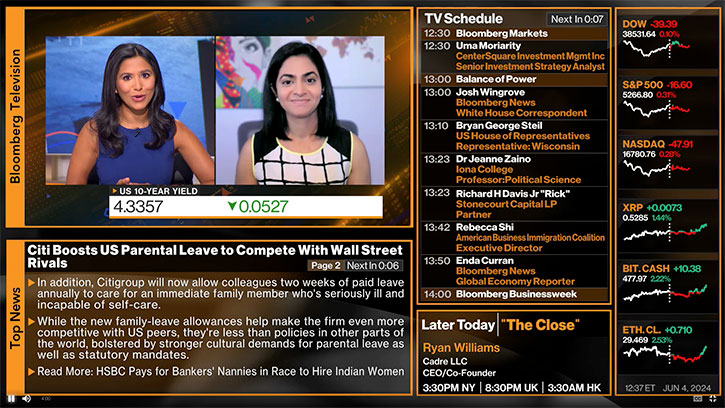

“The Service Industrial sub-sector represents a tremendous opportunity to capture outsized tenant demand with virtually no available supply or new construction in the foreseeable future. The infill, dense locations of the Portfolio allow tenants ease of access to their consumer base in high population growth markets,” said Robert Wasenius, Senior Vice President of Private Real Estate at CenterSquare. “We believe this investment in two of the top growth markets in the country, coupled with our institutional ownership and management experience of our partners at Ultimate, will improve the quality of the portfolio, enhance the tenant experience and deliver compelling risk adjusted returns to our investors.”

“We are excited to launch this partnership with CenterSquare and are looking forward to implementing our hands-on management approach to further enhance the portfolio’s value,” said Joe Sabbagh Principal and founder of Ultimate Realty. “Central and Southwest Florida continue to witness strong tailwinds from limited supply and increasing demand for well-located, small-bay and light industrial product. These mission critical uses, high replacement costs and diverse tenant mixes are the drivers behind our recently launched small bay vertical.”